Content

Besides the internal trouble this would cause, if the overdraw left the LLC with inadequate capital, the LLC could potentially lose liability protections. Your first option is to pay yourself in one lump sum at the How To Pay Yourself In An Llc end of the year. Your second option is to take staggered payments based on the Florida LLC’s expected annual profits. Those payments will be deducted from the company’s actual profits at the end of the year.

Readers are urged to reach out to us directly regarding specific legal questions concerning a specific situation. You can and should consult your bookkeeper or accountant to help you find the right balance between salary and dividends. Choosing whether to pay yourself as an employee or a contractor comes down to the IRS Common Law Rules, specifically the third rule that deals with the type of working relationship. When comparing LLCs to Sole Proprietorships, the critical difference is that a Sole Proprietorship can only have one owner and does not provide liability protection. If you’re setting up an account for a single-member LLC, you are the only one who needs to be present to open the account.

How To Pay Yourself As An Employee

However, keep in mind that the IRS requires you to pay yourself a “reasonable compensation” for your role. Third-party contractors often markup their services to make money. And, if your contractor charges an hourly rate (not a per-project rate) it’s hard to accurately forecast the final cost. General Partnerships are the preferred structure for many small and medium-sized businesses. A General Partnership is essentially an LLC business agreement between two people.

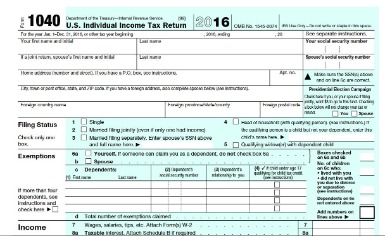

If you own a profitable single-member LLC, you’re going to owe payroll taxes. However, the portion of your income subject to them varies depending on your business entity’s tax treatment. Like any other wage-earner, you should have your income tax, social security, and Medicare automatically withheld from your paychecks. You can choose to pay yourself as a salaried employee and file a W-2 tax form. For business owners and start-ups, creating a Limited Liability Corporation (LLC) protects you from personal liability and provides specific tax benefits.

Can You Domesticate or Convert an Oregon LLC to a Florida LLC?

The LLC need not withhold taxes on distribution payments, meaning there are no W-2 or W-4 (employee withholding) forms to deal with. Instead, you will report your share of the business income on your personal tax return and pay income taxes and self-employment taxes on it. All LLC members are able to receive compensation in the form of year-end profit distribution whether they are active or not. Typically, the payout structure reflects each member’s ownership stake in the LLC. However, the precise payout ratios are determined during the formation of the LLC.

Doing this will generate a W-2 form that can come in handy when applying for loans in your personal life (mortgage, car financing, etc.). Pass-through entities report income to the IRS, but the partnership is not taxed. Instead, each partner pays part of the taxes on the company’s total revenue. The portion of taxes each partner pays is determined beforehand when the partnership agreement is written.

Are you required to take a salary from an LLC?

It’s important to keep your certificate when you receive it because it should include an EIN. Your EIN is a number that acts as a social security number for your https://kelleysbookkeeping.com/ business. You’ll need this number when setting up your business bank account. Your needs as a business owner will determine the best type of LLC for you.

Learning how and when to use each method of payment can potentially save you in taxes and avoid costly IRS penalties. Therefore, each partner includes his share of income in his income tax return. Furthermore, he is required to pay income tax and self-employment taxes quarterly. Unlike owner draws, guaranteed payments are treated as a business expense and have an impact on a business’s net income. In some partnerships, members may pay themselves either with owner draws, guaranteed payments, or a combination of the two.

Restructuring her business and paying herself as an LLC was the answer. This allowed her to take home the most money possible while minimizing tax obligations and limiting tax liability. An owner of an LLC is considered an employee if the LLC is taxed as either an S corp or a C corp. LLC members pay FICA self-employment taxes on all draws or distributions.

As for taxes, because you’re not required to file a separate tax return for a single-member LLC, you’ll be taxed on the net income earned by your LLC at the end of the year. Because an LLC in most cases is considered a pass-through entity, any net income it earned will be reported on your personal tax return. There are numerous options for paying yourself from your LLC, although the options can change depending on whether you’re a single-member LLC or a multi-member LLC. For example, if you operate solely, your LLC will be taxed as a sole proprietorship, while a multi-member LLC will be taxed as a partnership or corporation. Each member of a partnership multimember LLC pays a portion of income tax on its earnings, whether they draw it or not. The partnership must give each member an IRS Schedule K-1 (1065) detailing their share of the business income.

Typically, a company pays half of an employee’s taxes (known as FICA taxes) that contribute to Social Security and Medicare. If all of the LLC members in a multimember LLC participate equally in the operation of the business, you can’t pay one a salary and not the others. However, if you are the only member that has a management role, you can pay yourself a salary without setting up salaries for the other participating LLC members. If you choose to pay yourself as an independent contractor, you must file IRS Form W-9 with the LLC. Yet another option for LLC members to pay themselves is to hire themselves through the company.

- You’ll need a business bank account to pay yourself and your partners through an owner’s draw.

- A “reasonable salary” is any salary that you would pay someone to do the same job duties that you perform.

- Unfortunately, there’s no detailed explanation of what the IRS considers reasonable.

- For many LLC owners, the most advantageous way to receive payment is to treat yourself as an employee.

- Single-member LLCs are treated as sole proprietorships, but an LLC can also have more than one member.

- Say you’re the sole LLC member of an LLC taxable as a sole proprietorship.

Payroll services can take care of a lot of the heavy lifting for you once you decide how you’ll be paid. No matter your circumstances, consult an accountant or tax attorney to help you choose the right approach for your business. Paying yourself from an LLC can seem complicated, but it doesn’t have to be. If the business is regularly generating revenue and you actively work in the business, you’ll most likely pay yourself a salary or wages as an employee. But you have other options to explore if your circumstances are different—if the business isn’t earning a profit or you’re a shareholder who doesn’t actively work in the company.

How To Distribute Your Paychecks as an LLC Owner

An S corp is a pass-through entity and does not pay taxes at the federal level. To qualify as an S corp, an LLC must be a U.S.-based business and cannot have more than 100 owners. Neither can an S corp have a corporation or partnership among its members or carry multiple stock classes. If you expect your percentage of the year-end LLC profits to be $12,000, you could set up a draw to receive $1,000 each month as personal assets from the business bank account.

- But, in the case of partnerships, a group of persons rather than a single person have a claim on the revenue or business profits.

- Professional incorporation businesses like Better Legal, Zen Business, and Northwest will help you get all the information you need to file your articles of organization.

- A limited liability company, or LLC, is a common business structure recognized by all U.S. states.

- That said, these are the same taxes that businesses running payroll incur on any wages paid.

- Our Guides Legal Services team will explain the different ways you can pay yourself from an LLC so you can get the most out of your business’s profits.

Lascia un commento